The other tracking technologies work similarly to cookies and place small data files on your devices or monitor your website activity to enable us to collect information about how you use our sites. What are Cookies and Other Tracking Technologies?Ī cookie is a small text file that can be stored on and accessed from your device when you visit one of our sites, to the extent you agree. This cookie policy should be read together with our Privacy Policy.īy continuing to browse or use our sites, you agree that we can store and access cookies and other tracking technologies as described in this policy. This cookie policy explains how and why cookies and other similar technologies may be stored on and accessed from your device when you use or visit websites that posts a link to this Policy (collectively, “the sites”).

understands that your privacy is important to you and we are committed for being transparent about the technologies we use. Check Business Breaking News Live on Zee Business Twitter and Facebook. Get Latest Business News, Stock Market Updates and Videos Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. However, in case, PAN card is not submitted, TDS is 34.608 per cent of the PF withdrawal amount." Solanki further added that TDS on PF withdrawal will be deducted if the PF withdrawal amount is more than Rs 50,000. On the TDS norms on PF withdrawal before five years of PF account, Solanki said, "TDS will be deducted at 10 per cent provided PAN is submitted.

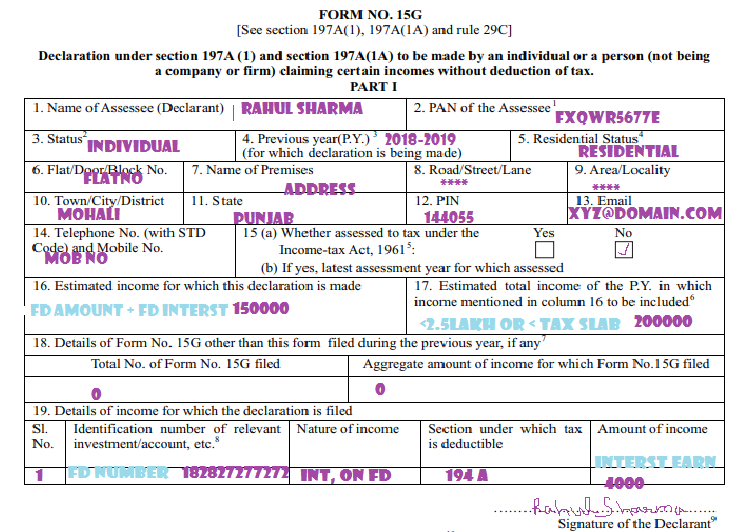

Standing in sync with Singhal's views in 15g/15h of PF withdrawal SEBI registered tax and investment experts Jitendra Solanki said, "Basically, form 15g/15h for PF withdrawal works like a declaration that one is having an annual income of less than Rs 2.5 lakh and hence he should be exempted from TDS deduction on one's PF withdrawal amount." However, he also said that the PF withdrawal amount will be liable for income tax payment if the PF account is less than five years old. FORM - 3 - Affidavit of Claimant/Parent(S) 4.See Zee Business Live TV streaming below: Certificate to be issued by Head of Establishment/Institution From Whom Benfit is to Given 3. FORM - 19 - Affidavit to be submitted with application Caste Certificate VerificationĤ. FORM - 3 - Affidavit of Claimant/Parent(S) 4.

FORM 18 - Application Form For Service 2. FORM 21 - Affidavit to be submitted with application for Caste Certificate Verificationģ. Certificate to be Issued by Collector/Election Officer 3.

FORM 20 - Application Form For Election 2. FORM - 17 - Affidavit to be produced along with Caste Scrutiny application FORM 5. FORM-15A-Certificate to be given by Principal of the School or College 3. FORM 16 - Application Form For Education 2.

0 kommentar(er)

0 kommentar(er)